How weather is shaping retail trends: Q2 2025

)

Retail WeatherIQ™

Retail WeatherIQ™ is a collaboration between the National Retail Federation and Planalytics that provides weekly weather impact outlooks for select product categories or retail segments compared with the prior year.

Retailers across the country are seeing firsthand how weather continues to influence shopper behavior in real time. From surging demand for cooling products during heatwaves to slower foot traffic on rainy days, weather remains a powerful force shaping retail performance.

NRF’s Center for Retail and Consumer Insights has partnered with Planalytics to launch Retail WeatherIQ to help retailers better understand and respond to weather-driven consumer behavior.

Read on for insights into how weather has impacted consumer demand in May and June, what’s unfolding so far in July and what retailers should be monitoring as hurricane season picks up.

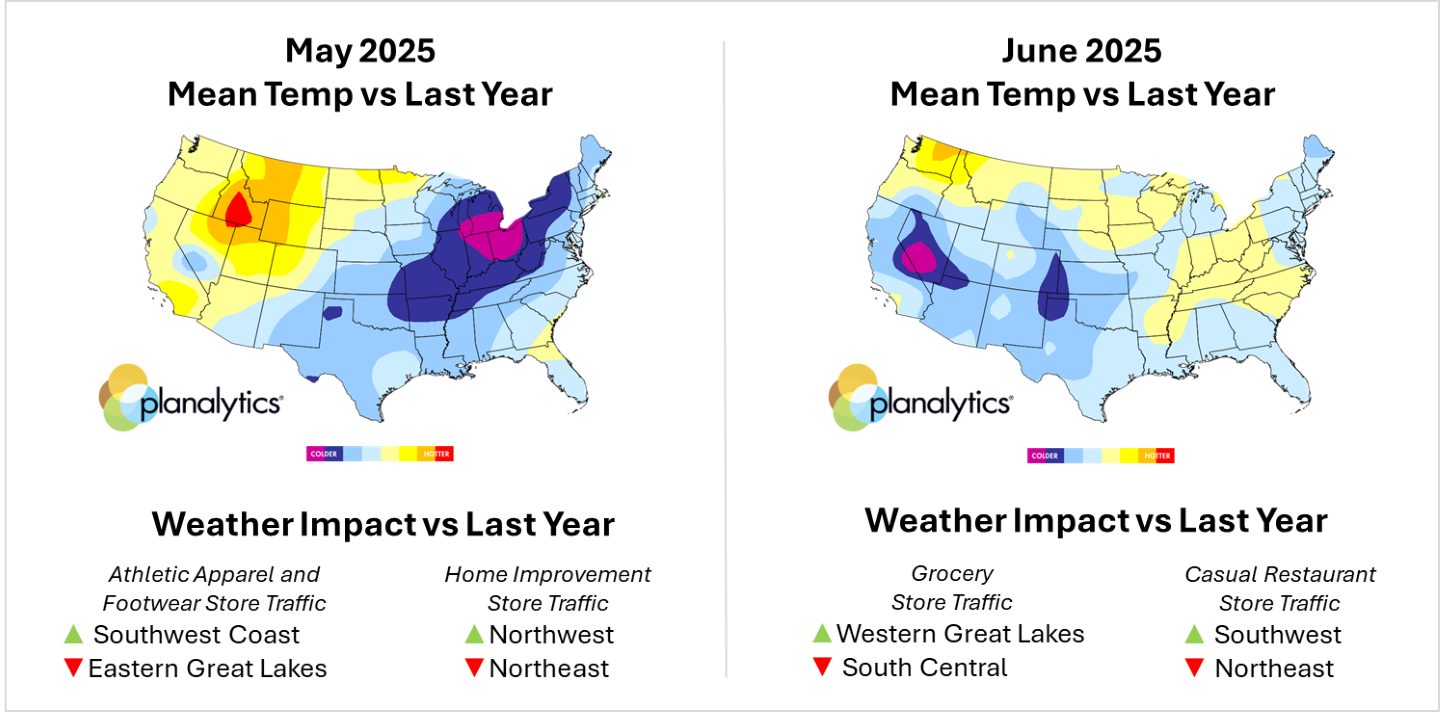

May and June: Regional variances

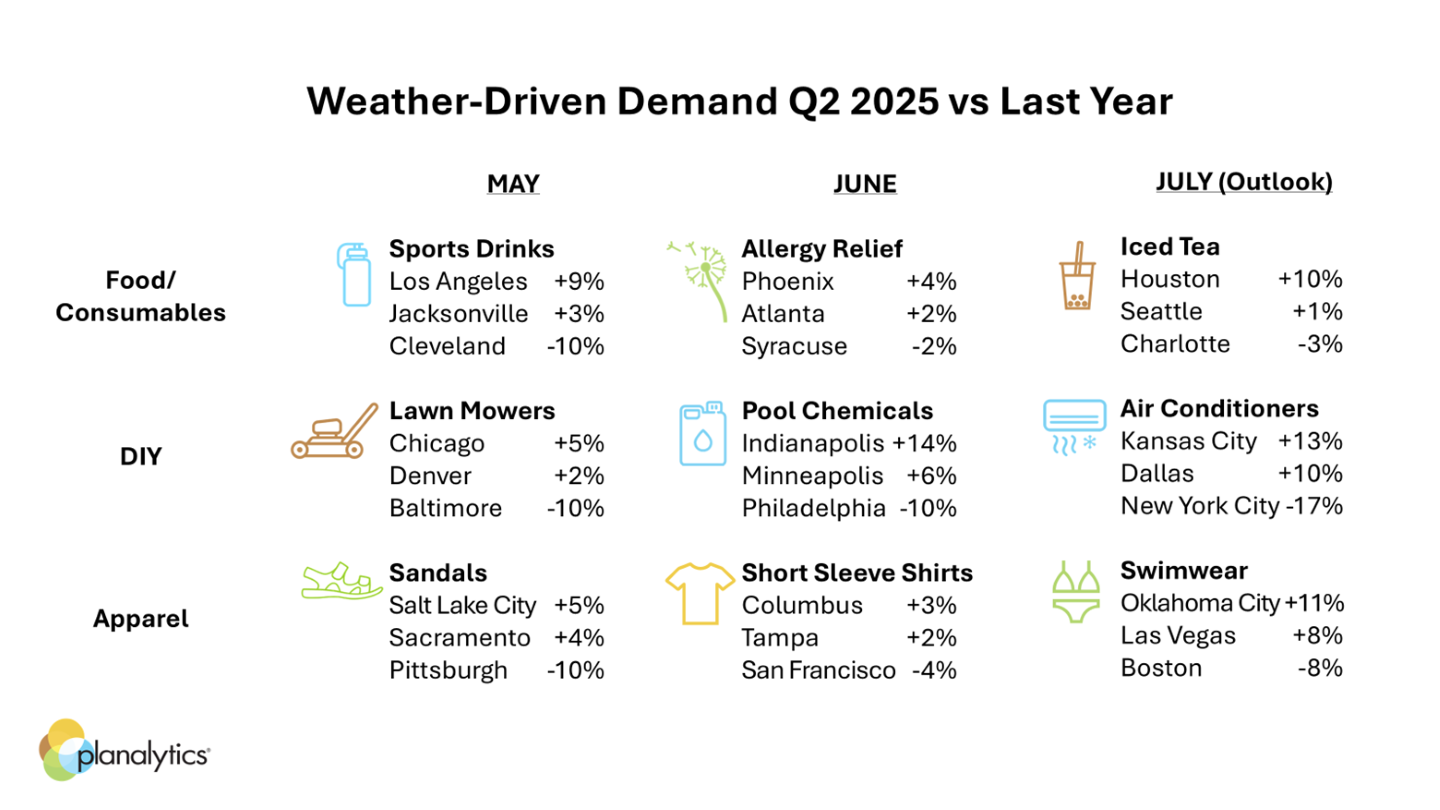

Dramatic regional variations were common throughout May and June this year. These months saw cooler and rainier weather than usual, with this year marking the coolest May since 2023 and the wettest June since 2021. Mixed weather across the country created sharp differences in consumer demand.

In May, severe storms disrupted large parts of the country, particularly the East, where unseasonably cool conditions delayed the start of the outdoor season. “Because of these conditions, consumers held off on purchases typically associated with early summer, such as lawn and garden equipment, patio furniture, and summer clothing,” says Evan Gold, executive vice president of global partnerships at Planalytics. In Baltimore, lawn mower weather-driven demand dropped by 10%, while sandal purchases in Pittsburgh saw a similar decline in weather-driven demand.

Meanwhile in June, the South and parts of the West experienced stretches of summer heat while the Midwest and East battled persistent rain. As a result, continued rainfall led to a 10% weather-driven demand decline in pool chemicals. Indianapolis saw weather-driven demand for pool chemicals jump by 14% as the heat settled in.

July: Shifting heat, localized storms

As we move through early July, Coastal areas are experiencing cooler than usual conditions, while central regions see rising temperatures. Gold points out, “This continued weather volatility across the country brings clear implications for upcoming retail demand.” In Kansas City, rising temperatures have driven a 13% increase in weather-driven demand for air conditioners, while New York City has seen a 17% drop. A similar trend is playing out with swimwear — weather-driven demand is down 8% in cooler Boston, but up 11% in warmer Oklahoma City.

Hurricane season: Preparedness is key

Looking beyond daily weather fluctuations, the Atlantic hurricane season, which began in June, is forecasted to bring above-average activity once again. An approaching storm can cause sudden spikes in demand for emergency items like bottled water, generators, and nonperishable food. “Over the past decade, the U.S. has seen between 10 and 30 named storms each year,” Gold notes. "In 2024 alone, there were 18 named storms, 11 hurricanes, and five major systems that made landfall in the United States.” Being prepared isn’t just about keeping shelves stocked, but also supporting the communities you serve and ensuring your business continues to meet customer needs when it matters most.

Looking ahead: Staying nimble in a shifting season

Whether preparing for heatwaves, storms, or anything in between, the summer season demands an informed and adaptable strategy. Regional forecasts, consumer sentiment and real-time sales data can all change quickly and impact inventory needs and promotional timing.

The key to staying ahead? Stay informed, stay flexible, and stay ready for what’s next. To learn more, visit the Retail WeatherIQ.